Radical Digital: Reimagining the enterprise for the digital age

[London, 23 April 2020]

The transformative potential of emerging digital technology is fast outpacing the ambitions and current implementation capability of most market incumbents in both the private and public sectors. Organisations continue to view digital transformation principally as the digitalising of their existing business paradigms and their existing business-as-usual (BAU) operating models.

There is nothing wrong with this medium-term focus per se. I have myself directed several transformation projects thus tactically defined and have successfully delivered significant business benefits. An ambitious digital shift often does rapidly mobilise the virtuous cycle of improving customer experience and revenue, while reducing service cost.

However, this predominantly tactical focus on improving the margins of an existing business model obscures the bigger picture and often impedes the development of more strategic (yet alone truly visionary) digitally disruptive business paradigms by many firms.

To illustrate with an example, let’s visit the exciting world of general insurance. The first shoots of this industry sprouted more than two thousand years ago, in the days of ancient Babylonian and Chinese traders. The insurance paradigm, which we recognise today, began blooming in Europe in the 17th century. The Great Fire of London in 1666, for example, greatly catalysed the emergence of popular property insurance. But then, since Enlightenment, not much has essentially changed in general insurance.

Sure, instead of using quill and parchment, we write contracts electronically. Underwriting, reinsurance and marketing have become much more sophisticated. Many traditionally manual tasks are now routinely automated. But the basic principles of the insurance market, insurer-(intermediary)-customer relationships and what constitutes an insurance contract have remained pointedly unchallenged for hundreds of years.

The outside-in strategic digital perspective

It would be sensible today to, say, deflect specific customer cohorts to digital self-service channels, and inform their choices through advanced machine learning and gamification, while keeping the underlying transaction logic (process steps, business rules, underwriting, pricing) and the actual end product (the traditional policy) largely unchanged. Meaningful business benefits (improved customer experience and revenue, at reduced service cost) would indeed be realised with manageable business risk and disruption.

Considering the truly transformative potential of digital, such a project illustrates a modest degree of ambition and is likely to deliver largely undifferentiated improvements. Many companies are already well advanced on the smart, digital self-service channel, machine learning and gamification adoption curves and competitors quickly copy any significant innovations. Despite what some self-declared ‘digital evangelists’ claim, tactical digital is an unlikely source of sustainable competitive advantage.

A more strategic and visionary approach to digital has two perspectives. The first is the outside-in strategic digital perspective, which explores emerging digital technologies with the question, “how could this specific enabler significantly transform my business?”. The emphasis here is on the phrase significantly transform, redefining through disruptive innovation, and not just marginally enhancing, critical operational elements. This is a strategic push approach, in that it evaluates the potential net benefit of a digital solution being pushed into the business. For each investment in such a candidate digital disruption domain, a balanced business case needs then to be argued.

An example of this perspective could be, “how could our insurance business benefit from adopting blockchain?”. Encoding (often complex and/or interlinked) insurance contracts as decentralised, distributed and public digital ledgers could deliver the benefits of recording every contract unalterably and in perpetuity and make such contracts accessible instantly, worldwide. It would facilitate the safe, remote collaboration of different workers and intermediaries who are often involved in constructing and selling complex contracts. Blockchain could also deliver significant benefits in areas such as fraud prevention and reinsurance.

On the negative side, for example, the insurer would need convincingly to manage current public perception, which is biased towards the view that blockchain applications, such as Bitcoin, are usually environmentally damaging and unsustainable. I cite a recent headline post from a professional technology discussion forum, “the consensus is that Bitcoin mining now takes up more electricity than Switzerland and that a single Bitcoin transaction could power a household for a day”. The insurer would thus need to demonstrate that it sources its blocks in an environmentally responsible and sustainable way.

There are of course several other adverse impacts, risks and complexities to strategically adopting current blockchain technology by the insurance industry. I’d be interested in your views on this.

The inside-out strategic digital perspective

The second perspective is the inside-out strategic digital perspective. This attempts to reimagine how, if we were designing our enterprise from scratch, we could harness digital innovation to best serve our customers, our stakeholders and us. Remembering that much orthodox business strategic theory, including Michael Porter’s Five Forces, remains as agonisingly relevant in the digital age as in the industrial age, we need to address some fundamental questions about the evolution or transformation of the enterprise.

Questions such as…

- what should our unique, digitally enabled market proposition (offer) be?

- what is the optimal, digital-first operating model to deliver this?

- how will we then sustain our competitive advantage and profitability?

- how will market forces and our ecosystem change (customers, suppliers, partners, distributors, competitors, society, etc.), how could we nimbly and continuously adapt to this and exploit such change to our advantage?

For each such question, we focus on how we could harness digital enablers and solutions to deliver the desired outcome. This is the strategic pull approach, in that it first describes the future vision for the business and only then defines the digital components required to deliver it. For me, this second perspective encompasses three significant advantages.

Firstly, it encourages scrutiny of digital not in terms of pros-and-cons of individual digital applications or innovations (such as blockchain), but holistically. It examines how various technologies could be blended together to deliver each digital transformation and its desired business outcome, whether this outcome is a re-engineered product or a radically restructured front-office.

Secondly, it naturally ideates the digital enablers and solutions that are needed to deliver the desired business outcome, but which may not be available (yet). The enterprise can then evaluate whether these are technically feasible and whether there is a business case for building (alone or in partnership) these desired digital capabilities. It’s important to note that such unique and/or proprietary shortfall applications of digital may prove to be the distinguishing basis for sustainable competitive advantage.

Thirdly, whereas the push approach is naturally biased towards digitally improving existing products and processes, the pull approach, by definition, looks well beyond the current business paradigm to challenge its axioms and entrenched modi operandi, with questions such as:

- “what should an insurance contract become?”, e.g. one could consider…

- deconstructing traditional policies (typically annual, renewable, non-modular) into customer-configurable, lean and simple microproducts, mixed and matched to the customer’s unique need;

- transforming pricing philosophy, by e.g.

- replacing the (usually annual) premiums with dynamic (incl. pay-as-you-go) and innovative (incl. non-monetary) fee options;

- offering instant, real-time and ATAWAD (anytime, anywhere, any device) access to protection, with context sensitive pricing;

- offer ubiquity, i.e. embedding (bundling) protection in/with other products and services, initially these could some obvious convergent offers, such as embedded protection for purchases (after all, few people enjoy buying insurance per se!);

- hyperpersonalising the buying experience and the resultant cover – every policy should be unique;

- ideating how to address customer needs with non-traditional products or services – e.g. by connecting customers to each other to create supportive social communities, which could share or aggregate protection in specific risk domains and/or collaborate to better manage individual risk;

- “how can we transform risk assessment?”, underwriting is crying out for some deep digital transformation, leveraging technologies such as IoT, advanced analytics and rich insight (including, where allowed, analysis based on customer movements, behaviours and social media footprint);

- “how can we accelerate our adapting to societal change?”, e.g. as society moves from an ownership to an access (sharing) model, the traditional approach to asset (e.g. car) insurance will need to adapt;

- “how do we rapidly evolve our culture and operations to best deliver our future products to our future customers?”, while ensuring that it will prove profitable and sustainable in the digital age, with the added capability to easily plug into emergent digital ecosystems.

Radical Digital Transformation: a summary

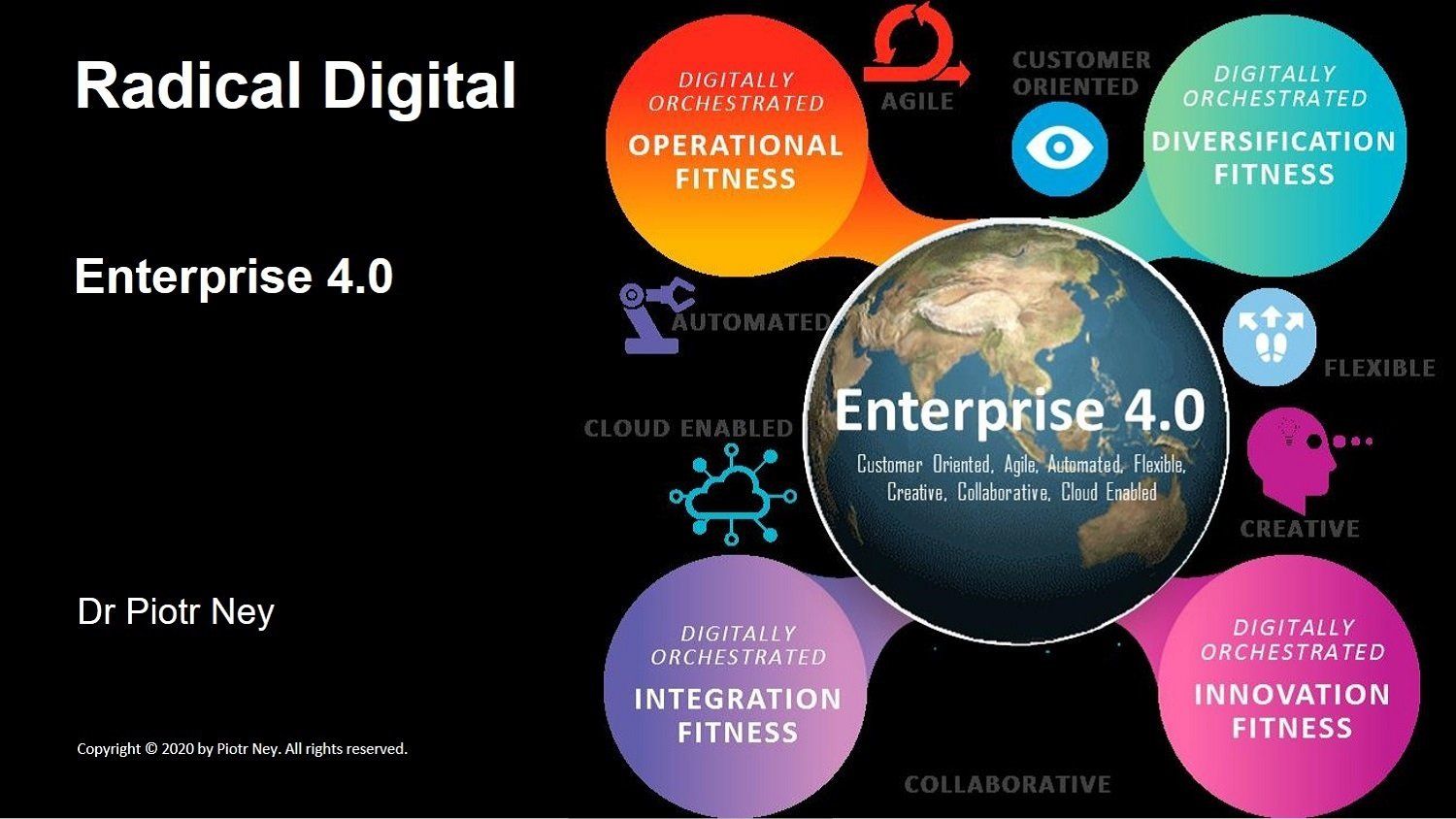

Digital transformation should be about deeply challenging what the business could and should be, including how to address existing customer needs in truly innovative and disruptive ways in the age of Economy 4.0. It’s about using an agile approach to develop digital enterprise fitness incrementally, instead of overinvesting in the up-front design of some fixed, future state operating model. It’s also about influencing customer careabouts and behaviours to create new, digitally-enabled blue ocean markets for our business and new cohorts of customers.

In many sectors, it may also be about actively challenging and influencing market standards and the legal, regulatory and compliance frameworks within which the business operates, to make such disruptive industry paradigm shifts feasible. Using blockchain for insurance contracts, an idea I mention above, is just one example of a digital enabler, which is still some way from clearing all the required market, regulatory and legal hurdles, before it could be adopted universally in mainstream general insurance.

Some ambitious start-ups fully appreciate the transformative potential of emerging digital technology and some of these will prove significant market disruptors. Most well-known brands, often burdened with complex legacies and fears of upsetting their existing markets, partners and customers, are reluctant to seriously explore the strategic and truly visionary potential of digital.

This article aims to motivate business leaders to embrace digital innovation as a radical catalyst to fundamentally transform their operating philosophy and market approach. It also argues that some fundamental archetypes of our economy, broadly unchallenged for hundreds of years, such as customer, product, supplier, payment, ownership and the axioms these populate, may now need to be reimagined for our digital age.

Dr Piotr Ney is an energetic promoter of innovation, digital transformation, customer and operational excellence, and sustainability, with some thirty five years of change leadership, consultancy and senior executive experience. He has an MBA in International Business and a PhD in Economics and Management, lectures part-time in Innovation Management and Disruptive Strategy and is a popular speaker at global business events. Piotr works in London and internationally as an independent consultant and educator.

Copyright © 2020 by Piotr Ney. All rights reserved. No part of this work may be published, reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of the author.